In our fight to #SaveOhioFilmJobs, media production professionals from all across the state have lent their voice in support of saving the Ohio Motion Picture Tax Credit.

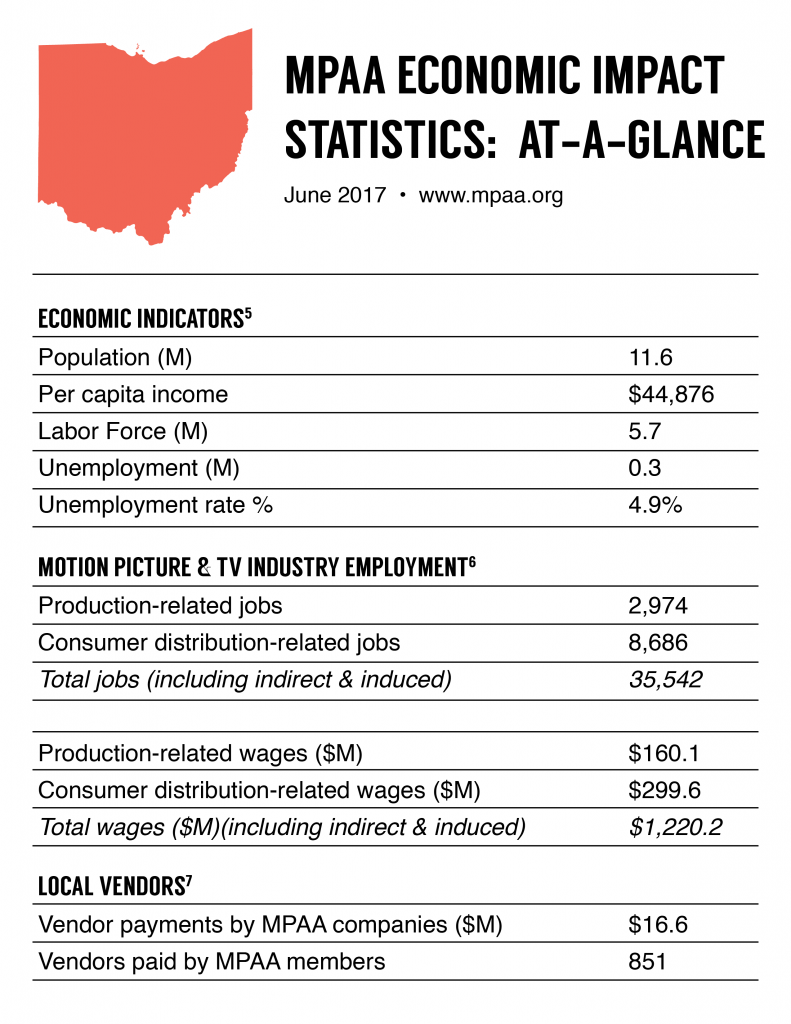

Since 2009, the incentive has been responsible for creating over 5,000 full-time-equivalent (FTE) jobs, and an economic impact of over $750 million.

Real jobs. Real people. Real economic impact.

These are just some of the thousands of faces that represent Ohio film, in their own words.

Help us #SaveOhioFilmJobs by clicking HERE.

Jada Taylor

Jada Taylor

Costumer & Seamstress

“My ultimate goal is to become a designer. I’m afraid if the tax incentive is taken away that I won’t get the opportunity to really grow…I would hate to see that taken away.

Andy Tarr

Andy Tarr

S.A.G. Actor

“I got my S.A.G. card here in Ohio, as opposed to a lot of my friends who went to the coasts. And I’m proud of that. I think it’s incredible that I’ve set up shop here, and I’ve seen the rise of the amazing network of people.”

Allie Toman

Allie Toman

D.G.A. 2nd Assistant Director

“I want to work here in Ohio where we can be anything that Hollywood needs. We need jobs, and they’re coming here. And we’re not just helping ourselves; we’re helping everybody. Film is everybody’s businesses and it affects everybody.”

Angela Boehm, Morganne Kaster, & Jason Tait

Angela Boehm, Morganne Kaster, & Jason Tait

Angela Boehm Casting

“We’ve been working here locally for seven years…We have seen a lot of people that have been brought up in Cleveland, filmed in Cleveland, and started here that are major players in the industry.”

Bill Garvey

Bill Garvey

Location Manager

“My job is directly dependent upon the tax incentive…I have worked exclusively in Ohio for 10 years based on the tax incentive. I personally, on these movies, spend anywhere between $250,000 and $3.5 million. That varies from project to project. Over the last 10 years, I’ve spent quite a bit of money here.”

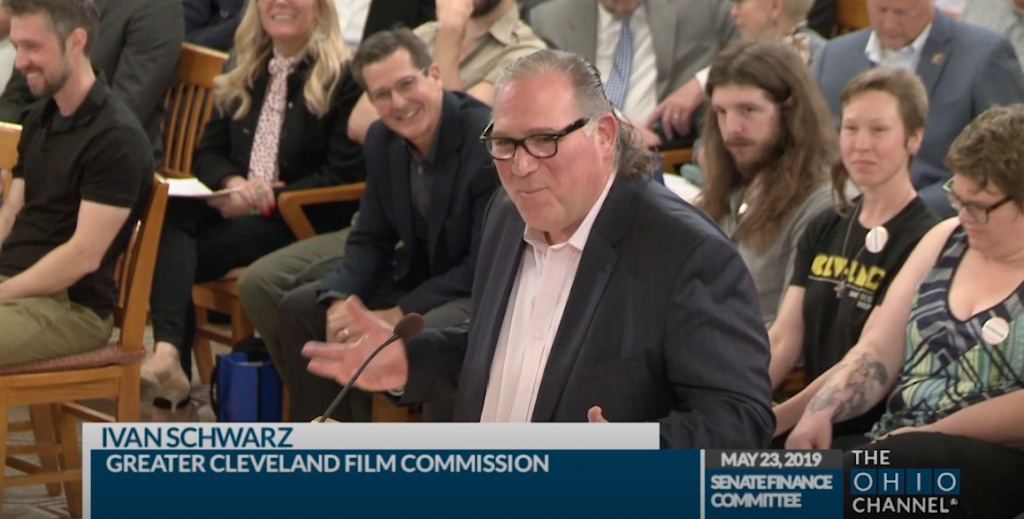

Cody Sherrill

Cody Sherrill

Producer

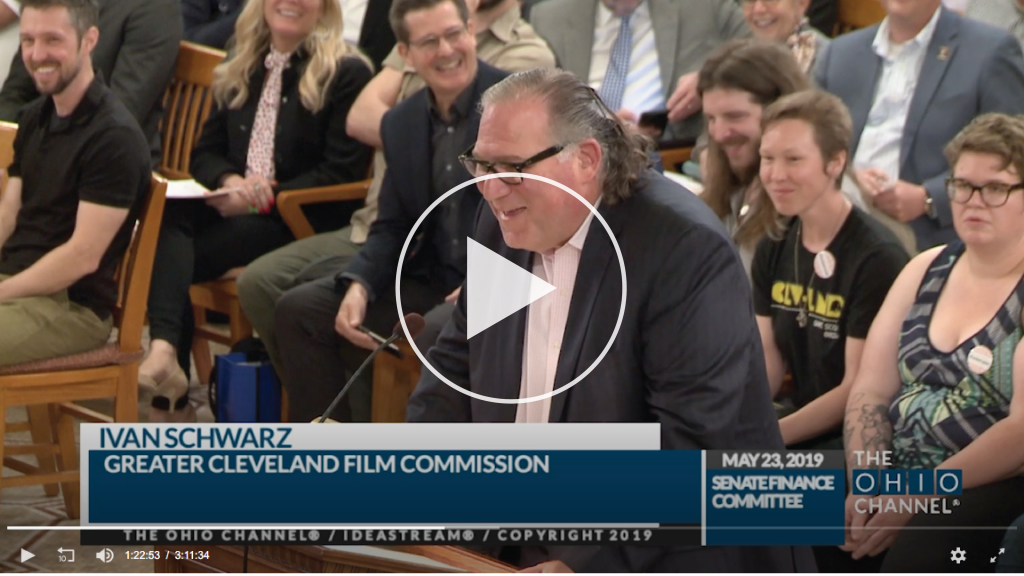

“The tax incentive does bring in big films, but like Ivan [Schwarz] said, it raises all boats. And the Indie film community definitely benefits from having those here. It brings in jobs that we can get trained on, it builds people up that don’t get a lot of set experience, and they need to get on something to learn…If you don’t have the tax incentive here, then there’s no way for us to be able to do that.”

Kacie Keefe

Kacie Keefe

Production Assistant

“I want to stay in Ohio; my family and friends are all in Ohio. I just want to make an honest living, and pay my taxes, and just be a part of this growing community. We can’t do that without the incentive.”

Jeff Yanik

Jeff Yanik

Video Production Company Owner & Freelancer

“If the tax incentive were to totally go away, and we no longer had a motion picture tax incentive in the state of Ohio, really, it would be devastating…It’s crucial that this incentive, that we keep it here, and that we keep expanding it so that we can be competitive with other states like the Georgias, Louisianas, New Mexicos.”

Kayse Schmucker

Production Assistant

“The tax incentive has been the entire source of my career for these last three years. I didn’t work in film, and then I started working in film in Cleveland, and ever since then, every film that has come in, I’ve gotten to work on. Without that incentive, those films would not have come in.”

Jesse Anderson

Jesse Anderson

Actor

“As I was trying to break into acting, I didn’t have much money or resources to get where I needed to be. If you don’t bring films to Cleveland people like me, and people in worse situations like me, are suffering because we won’t have the technology, or the resources in Cleveland. People sacrifice their lives, their families, and their homes to film. And if you restrict us from that, you’re basically killing us all.”

Linda Bruff

Linda Bruff

Former Crew Member

“I used to work for the show called The Vampire Diaries. They didn’t build a huge soundstage. They actually went and took over an old, abandoned textile mill and converted four or five warehouses into their soundstages. It completely revitalized that really suburban area. So please, please whatever you do, let’s bring film to Cleveland. Let’s bring film to Ohio. And in fact, if you want to get rid of the tax cap altogether, I would love for us to go head-to-head with Georgia.”

Joe Thompson

Joe Thompson

Grip/Electric

“When these folks come here, they’ve got to pay to be here. If they know that you will match their funds, they will continue to come, continue to spend, and we will continue to grow…A lot of people don’t know that one of the biggest, cheapest exports from this country, around the world, is films. Films make a lot of money all over the world. If we could become a center of filmmaking, we will benefit. We’re trying to make Cleveland a world-class state city.”

Liz Vondrak

Liz Vondrak

Craft Services

“The tax incentive means the last seven years of my career that I’ve built, staying here with my family, buying a home, and being with the crew and family that I’ve worked the last seven years with and love. I don’t want to leave, I don’t want to start over somewhere else.

JT Diamond

JT Diamond

Vendor – Environmental Cleanup

“That first shot when The Avengers came to town, year ago, gave me $130,000. I put a dozen guys to work for 3-4 months, and it gave me a kickoff and started my company. I’ve worked on 20-30 movies, a little bit here, a little bit there, but it has helped my family be able to live here and stay here. We need this drastically.”

Mary Ann Ponce

Mary Ann Ponce

Director of the Chagrin Documentary Film Festival

“The tax incentive is enormous to the Chagrin Documentary Film Festival because it supports the film industry, not just in Northeast Ohio, but all over the state of Ohio. We draw filmmakers from all over the state, and this is the fabric of our film community here in Northeast Ohio. It will destroy the fabric of the film community entirely.”

Kiely Cronin

Kiely Cronin

Assistant Camera

“I’ve worked this business for 30 years now. I had to leave Ohio because there weren’t enough films being made here. The tax incentive passed, I had to come back for family reasons, I love being here. I don’t want to leave. This is what’s driving the business in Ohio. It needs to continue. If it were to go away, I probably would move.”

Kelleigh Miller & Sarah Willgrube

Kelleigh Miller & Sarah Willgrube

Production Designer & Prop Master, Script Supervisor

“This tax incentive is very important. We’ve been working here in Ohio for over a decade. Every production that comes through; commercials, feature films, everything from The Avengers to Love Find You in Sugarcreek, we’ve loved working here…A big group of us grew up together, and a part of that was the tax incentive. We are a film family, and the tax incentive affects more than just the immediate workers; it affects our families, it affects our vendor’s families. Losing that would mean losing family.”

Ryan Kelly

Ryan Kelly

Entrepreneur

“Without the tax credit, and without the support of the film commission, it puts a very big thorn in the side of the business that I’ve trying to create, and the industry that I’m trying to create here in Cleveland and in Northeast Ohio in general…We need these jobs to stay here so that this industry can grow from the ground up, and be a legit, Cleveland strong industry.”

Shawna Foley

Shawna Foley

Costume Designer

“The film industry really offers a lot of opportunity to a lot of different people. Whether that’s crew members, food service, construction, painting, retail; there’s an opportunity in film for you to work in film! I think it’s a really good industry to support locally…Keep the incentives, raise the incentives, just keep that work here because I believe that it can have a really positive impact on Cleveland. It gives people an opportunity to make a living wage, beyond a living wage! It’s a good living.”

Scott Hallgren

Scott Hallgren

Composer, Sound Editor, Educator

“If the tax incentive leaves, it takes away the opportunities for internships, it takes away the opportunity for jobs, it takes away the opportunity for people to grow into something here, from an industry standpoint, from an educational standpoint, and from a commercial standpoint, quite honestly. You want people who have the opportunity to say, ‘I want to live here, and I can now do this work from anywhere in the world; I don’t have to live in Atlanta, I don’t have to live in L.A. or New York. I can do this work from here.'”

Schuyler White

Schuyler White

Special Effects Coordinator

“We don’t want it to go away, because if it goes away, everybody is going to be moving out of town. It’s going to become the next North Carolina. North Carolina had an amazing tax credit. They took it away, and it’s literally a ghost town now. It was a thriving movie town, had great jobs, great everything. Now, North Carolina is literally a ghost town; all it is is a vacation town. And they’re even talking about bringing their tax credit back because it made such a big dent to their economy that it messed up a lot of things for them.”

Weasle Strychnine

Weasle Strychnine

Teamsters Local #407 & Picture Cars

“Without this tax incentive, I’m not going to make any money. I help support a 90-year-old mother of mine, I take care of my gal, a rescue puppy and a rescue cat. I have seven cars and three vans that I pay insurance on, that I pay taxes on; they’re for movies. I also pay taxes on three houses and a lot in the city of Cleveland. Without this work, I’m going to have to leave.”

Diana Frankhauser

Diana Frankhauser

Actress

“I want to be able to support film in this market, in the hopes that maybe one day this will become the next big market. And so far that’s been holding true…We’ve worked so hard for this over the past couple of years, within the past decade with the tax incentive. By taking it away, we’re taking away everything we’ve already built.”

John Vourlis

John Vourlis

Director & CSU Instructor

“Do the math, think about it. Do you want to grow Ohio? Do you want to see people come back to Ohio? We have lost an enormous amount of talent and people in the last twenty years because jobs left. The industries Ohio relied on have shrunk or left…That’s what I think the governor would want; jobs for young people who are going to stay here, plant roots, pay taxes, grow families. All those things that Ohio is really perfect for. Give them a job, and what else do they need?”

Monica Plunkett

Monica Plunkett

Property Master

“Films will not continue to come to Ohio without the tax incentive. It simply won’t happen; they can get a better deal in another state. This is an industry in which we need to be patient in its development. Its effect on the economy has a ripple effect, some that you may not even realize; in terms of businesses, in terms of product placement, and in terms of offering employement, which I pay taxes on in the state of Ohio. People like me.”

Chris Singleton

Chris Singleton

Storyboard Artist & Locations

“If the tax incentive were to leave, I think it would put myself, as well as a lot of people, into a bit of tailspin, because it’s so unexpected. And I think it would be very tragic, specifically for the Ohio area because so many of us would be forced to relocate somewhere else in order to find work. That would ultimately cripple the economy a little bit in Ohio as well.”

Jessica Houde Morris

Jessica Houde Morris

Houde School of Acting

“I have over 100 studnets, and it keeps my students here rather than going to Atlanta, or New York, or L.A. They’re staying here because they’re actually getting work here.”

Marlowe Taylor

Marlowe Taylor

Sound Mixer

“To know it might leave, hurts. To know it might leave…because then what happens? What do I tell my daughter who’s doing this? What do I say, you know, ‘Ok, I gave up.’ What do we do? And I don’t think they get that. I think that they should consider that.”

Cayla Koslen

Cayla Koslen

Production Assistant

“It’s always been my dream to work in film; I’m incredibly passionate about it. If the incentive goes away, there goes my dream.”

Vincent Sarowatz

Vincent Sarowatz

Actor

“You’re not looking at just potentially losing the actors, the crew, and the writers, and all of that. It’s their families. You’ve got the opportunity for all those people to leave Ohio.”

Rebecca DeNoewer

Rebecca DeNoewer

Costume Supervisor/Set Costumer

“It’s not just about displaying products and services in Cleveland, but also we spend pretty much our entire budget here in Ohio when we’re working on a film.”

Max Eberle

Max Eberle

Production Coordinator

“My own insurance would be a lot harder to figure out. My wife has some medical issues, and without that insurance, I don’t know what we’re going to do.”

Kassie DeAngelis

Kassie DeAngelis

Set Decorator/Set Dresser

“I hire local artists, I use local vendors. I try to bring people into this that don’t really have the experience. I rent from people that have never done this before, as well. I think that helps the local businesses and the local economy. It’s the bread and butter of anything creative…It’s not really an option for me to be like, “I want to go pursue a different career path, or do something else,’ This is something that’s really important to me”

Mark Hamer

Mark Hamer

Director

“This is our job. This is our 9 to 5. This is our career.”

Teresa Strebler

Teresa Strebler

Set Dresser

“They’re not temporary jobs, they’re freelance jobs. We are here spending money, we’re here making money. We’re freelance. It may only be 8 months of work out of the year, but it’s the same amount of time. I did the math once: if you work 8 months at 12 hours a day, it works out to the exact amount as 12 months at 40 hours…”

Steve Campanella

Steve Campanella

Producer/Line Producer

“It’s really the people of Ohio that contribute to making every film that comes here.”

Kirsten Hock

Kirsten Hock

Art Department

“The connections that we’ve made with the neighborhoods, all of it. I’ve learned so much about Cleveland doing this job. Going places I would never otherwise even know about. Seeing directly how we’ve impacted those neighborhoods, and the people involved, and the vendors we use, it’s part of the movie magic for me. I don’t wnat to lose that.”

Matthew Divis

Matthew Divis

Actor/Stunt Performer

“If the incentive were to go and leave, me and a lot of my friends would have to do the same. If the dream goes somewhere else, we will have to chase it…I am one of those 35,500 people who are chasing my dream doing this.”

Rich Fishburn

Rich Fishburn

Locations

“I did six years of active duty, and when I got back, I attended Tri-C. I got two Associate’s degrees in film and digital media, and because of the tax incentive, I was able to get on The Fate of the Furious…If the incentive is totally done, in all honesty, I don’t know that I would be able to provide for my family.”

Jeff Lange

Jeff Lange

Sound, Set Dresser, Propmaster

“How much did we just put into Cleveland State’s film school? How many students at CSU are Cleveland natives, still living at home and going to school? Now, we’ve created this school that is fostering growth in an industry that no longer exists at home? We are now training people to leave, that’s what’s happened. With everything that we have put into CSU we are taking young minds and going, ‘Here’s how you do a job, somewhere else.’ That’s insane.”

Bryan Robinson

Bryan Robinson

Production Assistant & CSU Film Student

“The film incentive and the film school are kind of a package deal. I was assuming when I came out that they were going to have this community that was going to help us get jobs and stay in Cleveland…There are big crews of people that you don’t see behind the camera, but they rely on this as a means to make a living, to support their families, and want to stay in Ohio. And I would like to be one of them.”

Vince Calabrese

Vince Calabrese

Set Dresser

“The tax credit has allowed me to work on features without leaving home. Working in the midwest, we’re able to work on features here where they are typically not big budget, but they are movies where you can be in a position and view everything. You can learn so much in every single department while working in Ohio. I’ve worked in locations, I’ve worked in camera, I’ve worked in the A.D. department, I got a taste of everything. And you don’t get that everywhere else.”

Mike Suglio

Mike Suglio

Director, Founder of Short Sweet Film Festival, CSU Instructor

“If the Ohio Motion Picture Tax Credit is no longer available and simply just does not exist here in Ohio, it’s going to affect me in many different ways. I don’t know how many teaching opportunities are going to be at the film school because I simply don’t know if many students will want to enroll in this program any longer. It would be very poor of us to make false promises that there will be jobs after graduation when I know 100% there won’t be. I don’t like lying.”

Charles Moore

Charles Moore

Director

“I always loved the idea of getting into movies. Watched Cleveland when there wasn’t an incentive, hoped that we would get one one day and that would provide opportunities for somebody that was from this state to be able to produce movies in their hometown and was eventually able to do that. I’m very proud of that.”

Joe Quinn

Joe Quinn

Producer, Director, Writer, Actor

“There’s a misconception that our tax incentive is a handout. It’s not a handout. It is a rebate, more than anything. The money has to be spent in the state of Ohio before money can go back to the productions. This incentivizes more productions to come here and create a thriving industry that will create thousands of jobs. Production jobs, actors, but also vendors, the locals, the restaurants, hotels, construction, all of that benefits from a film production.”

Contact Your Lawmakers –

Contact Your Lawmakers –  Share on Social Media

Share on Social Media

Send us a Selfie or Headshot –

Send us a Selfie or Headshot –