Greater Cleveland Film Commission President Evan Miller settles into his new office overlooking Lake Erie.

Source: Cleveland Jewish News • Skylar Dubelko

January 20, 2020

For Evan Miller, “all roads lead to home.”

After a 15-year stint as a Los Angeles talent agent, the graduate of Orange High School in Pepper Pike and The Ohio State University in Columbus, returned from Tinseltown to take over the Greater Cleveland Film Commission.

Miller said the driving force behind his career change was family.

“I loved my time in Los Angeles,” he said. “I loved what I was doing.”

But as the father of a 5-year-old daughter and 2-year-old son, Miller felt his children lacked opportunities to be around their grandparents and cousins.

That “was such a valuable part of my childhood growing up,” he said. “At a certain point, it didn’t feel right that they weren’t getting to spend all this time (together).”

Miller became aware of the Greater Cleveland Film Commission shortly after the birth of his daughter.

After reading a number of scenes in Marvel’s “The Avengers” that had been shot in Cleveland, Miller recalled, “I just thought, ‘Somebody in Cleveland is doing this. Who is doing it (and) how can I get in touch with them?’”

Timing was kismet

Miller found former president Ivan Schwarz’s name on the internet, sent him an email, then cold-called him.

Schwarz got back to him within a couple of hours.

Which, in “the entertainment industry, isn’t always typical,” Miller said.

The two had a lunch on the books just a few weeks later.

“I told him, ‘I don’t know if I can do anything to help you in my current position, but I am a crazy, diehard Clevelander,’” Miller said. “Being out there really galvanizes your fanship, because I was no longer surrounded by all Cleveland fans. I had to go and represent a little bit out there.”

Over time, they established a relationship, Miller said, and he hoped for an opportunity to work with Schwarz.

“(I) never anticipated that I would be stepping into his shoes,” Miller said.

But as his contract was starting “to wind down” at Abrams Artists Agency, Inc., Miller and his wife started to consider where they wanted to raise their young family.

“The timing just kind of aligned,” Miller said. “When (Schwarz) let me know that he was going to be leaving, I jumped at the opportunity and kind of put all my chips in the middle.”

Prior to moving home and ultimately settling in Brecksville – “my wife grew up there and loved it,” Miller said – he feared it might be difficult to translate his skills, and his work in Los Angeles’ entertainment industry, to Cleveland.

The former agent is quick to acknowledge the “very steep learning curve.”

“I’m going from working for a business where you are appreciated based on the amount of dollars you bring in,” Miller explained. “I’m coming now to a nonprofit where my job isn’t to drive revenues for my organization. It’s to drive revenues for a city and for the individual workers.”

Fortunately, Miller has spent time studying incentives to understand “the value of how those work and how those drove production out of LA.”

Holding out a carrot

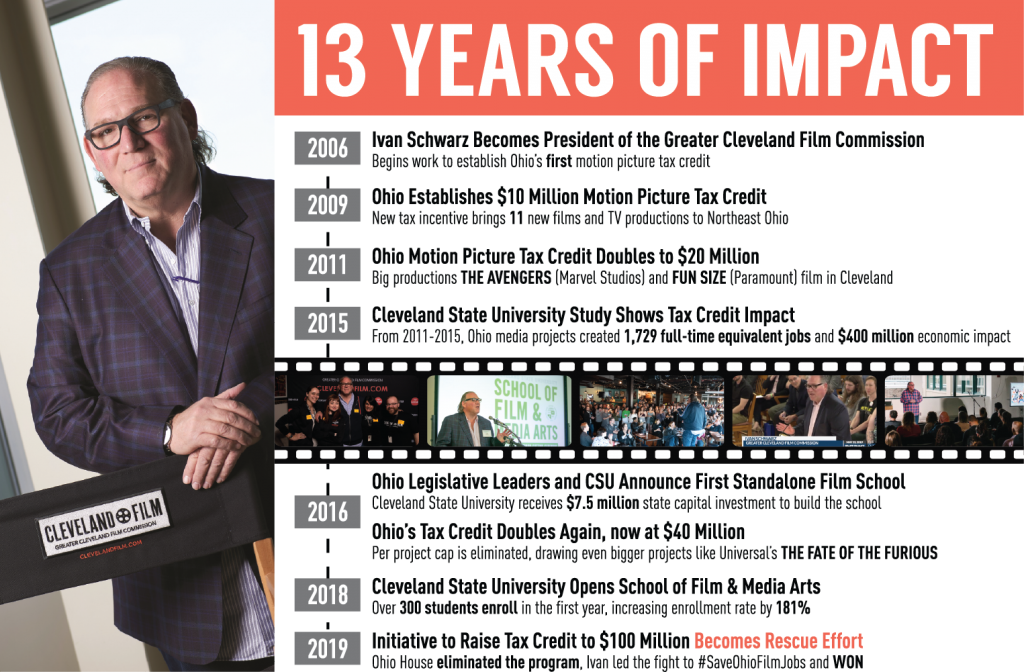

Through the Ohio Motion Picture Tax Credit, the state sets aside $40 million a year for a tax break that funds up to 30% of eligible film production activities. The tax credit can be taken against the commercial activity tax, financial institutions tax or income tax.

Schwarz, who led the film commission for 13 years, was instrumental in introducing the tax credit.

“The tax credit and this industry really isn’t here without him,” Miller said. “As production started shifting away from Los Angeles, (the tax credit) was going to be the hook to get people here, and once we get people here, they tend to really enjoy it.”

From a business standpoint, Miller said production companies who choose to film in Cleveland are getting better value on the dollar.

“But then they’re also dealing with people who are coming to work on time and are working hard and are friendly to work with as well,” Miller said. “The impediments to production that you find in a lot of other big cities, you don’t find here and that goes a very long way.”

Miller officially started his role in August and describes himself as having been “extremely fortunate” early on.

“To come in and have pretty much three concurrent productions over the past four months, you can’t ask for more than that,” Miller said in reference to “The Minuteman” with Liam Neeson, the “Untitled Fred Hampton Project” and “Cherry,” directed by Cleveland-raised brothers Anthony and Joe Russo.

“But the reality is, with a $40 million incentive, that money’s pretty much burned up,” Miller said. “We don’t want to be in a situation where we’re busy for three to four months out of the year and then we’re sitting vacant for the rest of the year.”

Miller knows that, without the tax incentive, production companies are unlikely to consider filming in Cleveland.

“So a big part of what we’re trying to do is to raise that and make sure people understand where the value is,” Miller said. Noting the Russo brothers’ goal was always to film “Cherry” in Cleveland, Miller explained problems with the tax incentive almost forced production elsewhere.

“It did not look like that film was going to shoot in Cleveland, even though it took place here and even though the Russos are from here and are such advocates for the city,” Miller said. That just “speaks to the value of the tax incentive.”

Without the financial benefits the incentive offers, Miller admitted, “It would have been possibly more economically advantageous for them to shoot in LA and to double as Cleveland, as crazy as that sounds.”

“But thankfully, because the incentive was saved, the finances lined up,” Miller continued, “and, again, they wanted to be here, the film takes place here, so it all made sense.”

While the other two productions were shot in Cleveland, the films are set in Chicago, Miller noted. “We were able to double as Chicago. We offer a much more financially feasible way of doing it than it would be to shoot” there.

At the end of the day, Miller said financiers will choose whichever filming location gets them “the most bang for their buck.”

Asked about the future of the commission, Miller said the goal is to ultimately have a film studio in Cleveland.

“But it has to be done right,” he said. “This is not a typical business where, if you just hang a storefront and you have good people running it, all of a sudden you’re going to have people coming in.”

A studio in the future

With the tax incentive’s current structure, a Cleveland-based studio might sit empty for most of the year.

“Economics aside, the optics of that alone aren’t good. It doesn’t look good to have a brand new studio that’s not being used,” Miller explained. “So our hope is that, if a studio is going to be built here, it’s done in conjunction with the tax incentive being raised to $100 million.”

Cleveland has already come a long way since Miller left 15 years ago. Noting there are “so many” programs in place that weren’t available when he was growing up, Miller said the fact that young Clevelanders can break into the entertainment industry in their hometown excites him.

“And then ultimately not be in a position where they’re forced to leave,” Miller added. “You don’t have to necessarily be in New York or LA. You’ll have the skill set to go do so, but if you want to stay local, if you want to start building your career here, you have the opportunity to do so.”

During his time in Hollywood, Miller was often grateful for the Midwestern values he grew up with; they served him well in interacting with colleagues.

“The nice thing about being at an agency is that you really are aware of the entire city’s business,” Miller said. “So you know what’s going on at all the studios and management companies and agencies. Through the course of doing that over the years, I built enough rapport and trust that I have a lot of these good contacts that are willing, excited to help.”

He said nobody was surprised when he made the decision to return home.

“It made perfect sense ‘cause they all knew me as the Cleveland guy out there,” Miller said. “Again, I loved Los Angeles, but I’m very much a Midwesterner and have Midwestern sensibilities. Being out there for so long, I realized the positive impacts being here had on me. I was … successful because a lot of the lessons that I learned here from my family, which had been rooted in how Cleveland does things.”

His children are adjusting well to Cleveland and the “family-centric and positive environment” it offers, Miller said, adding they recently got a puppy and spent the holidays with extended family.

“It was nice to be able to have the entire family around and lighting the Chanukah candles this year,” Miller said. “Not doing it via FaceTime, and having my daughter … light them and exchange presents with her cousins, who we would only see once every two to three years, that stuff is worth its weight in gold.”